Online payment apps are everywhere. From PayPal’s founding in 1998, the industry has grown into a true behemoth. With transactions in 2020 of $1.3 trillion, the apps are used for everything from transferring money between friends to small purchase to incredibly profitable scams. The Zelle money scam, even if you don’t already use the app, is one that could cost you everything.

What is Zelle?

Oh, what a tangled web we weave. Zelle is an easy-to-use payment app that is owned by Early Warning Services, LLC. Based on the name, you might expect this to be an app with lots of protections for consumers—until you realize that the company is owned by seven of America’s largest banks: Bank of America, Truist, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo. The other warning sign should be that the banks created Zelle to take business away from Venmo—which is owned by Paypal.

What is the Zelle money scam?

Let’s be clear—Zelle isn’t perpetrating this money scam, but they may not be doing enough to protect consumers. After all, Zelle’s philosophy is that you should Treat Zelle like cash. They also suggest you only use Zelle with family and friends. But that’s not what people do.

The message

Like most online scams, this one begins with a message. The message, of course, is spoofed, meaning that it’s supposedly from Bank of America or Wells Fargo (but not). It ‘warns’ you about a pending payment that you must stop by replying or calling the number provided.

The scam

Whether you reply to the message or use the number provided to call the bank, the person on the other end of the communication is not actually with a financial institution. That person has been trained to trick you into believing someone compromised your account and that the only way to protect yourself is to move your money—using Zelle.

The outcome

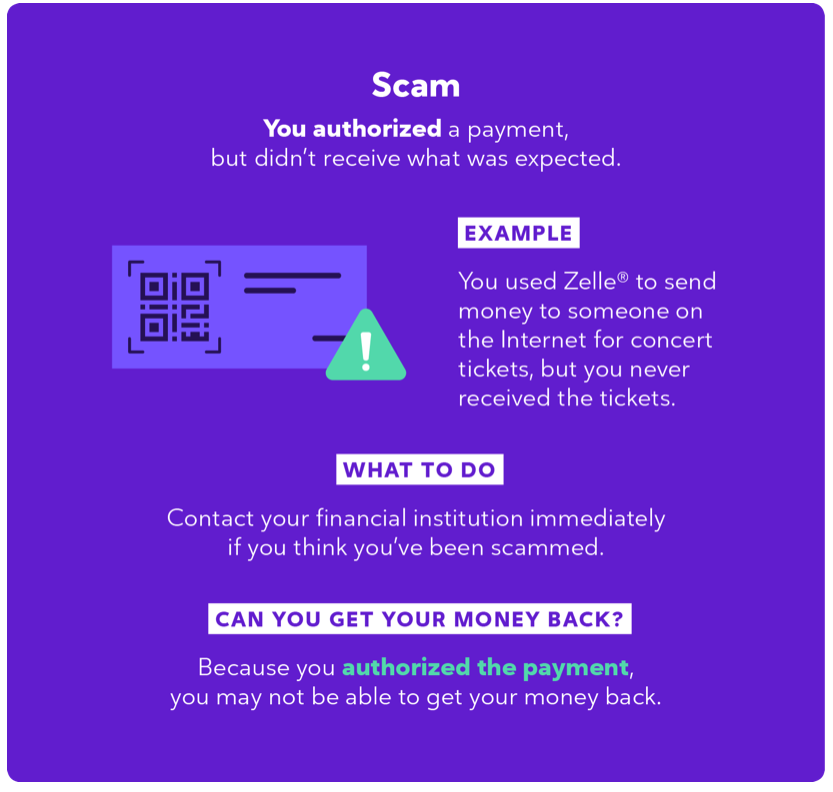

The scammer guides you through using your Zelle account (or of creating one) to move all the money in the supposedly compromised account to a Zelle account. Unfortunately, you don’t own that Zelle account; the scammer does. The end result is you’re out a lot of money for a transaction you authorized. (Hint: since you approved the transaction, Zelle considers the transaction to be legitimate.) The bottom line? You’re the one who loses out.

Bonus Tip: Online sellers aren’t immune

Scammers are using the spoofing concepts to convince online sellers that they’ve paid when they haven’t. The scam might begin with a notification from your bank that you’ve received a Zelle payment (it’s a fake). Or, it could demand for a refund because there was ‘a problem’ with their payment. Either way, online sellers need to be especially careful with Zelle payments.

4 tips to avoid the Zelle money scam

Tip 1: Be aware that the message you received may not be from a legitimate source. If you want to check on the transaction, follow the next tip.

Tip 2: Verify the details of any Zelle payment with your bank or financial institution by calling them on a number you know is theirs. (This is NOT the one the scammers provide!) If you’re comfortable using the bank’s website, that’s a great way to verify any transaction.

Tip 3: Walk away if someone you don’t know insists on using Zelle. Scammers have reasons they insist on using a particular payment method. Zelle is just the latest addition to a list that includes Western Union, Green Dot MoneyPak, and more.

Tip 4: Report fraud to Zelle. You may or may not get your money back, but you may help someone else avoid the same mistake.

I’d love to hear from you if you have a suggestion for a future scam tip or would like to share your experience with a scammer. And if you liked this tip, why not check out last month’s tip, 5 tips to prepare for a cyberattack.

Book Birthday Launch Contest

The contest will run through June 1. Recipients of The Friday Morning Post are eligible to receive 3 bonus entries. If you’re not subscribed to The Friday Morning Post, you can get bonus entries by joining the mailing list using the form at the end of this post.

a Rafflecopter giveawayTerms & Conditions: No purchase is necessary. You must be at least 18 years old to enter. By submitting your entry, you agree to be entered into Terry Ambrose’s email newsletter list. Your information will not be shared with anyone else, and you may unsubscribe at any time. Winners will be chosen by Rafflecopter from all entrants for the prize. Winners will be notified by email. Terry Ambrose is not responsible for transmission failures, computer glitches or lost, late, damaged or returned email. Prizes must be claimed within 5 days or they will be forfeit. Physical prizes for U.S. mailing addresses only. International winners may choose from our ebook options. No transfers or substitutions are allowed. Winners must pick from the books offered.

If you are not receiving The Friday Morning Post via email and would like to join the mailing list, use this form to register and receive your bonus entries.

Thanks for the information so many scams going on.

Thanks for the information!

thank you for this wonderful give a way. I am loving your covers and the stories sound amazing

Thank you for the information about this scam.

Good info—ty.

Thanks for sharing information about scams!

I was just hearing a little bit about this on the morning news!

My favorite place to visit is the San Diego Zoo