With all the data breaches over the past couple of years, it’s no wonder that Apple Pay is being well-received by consumers, retailers, and financial institutions. The service has the potential to exponentially improve consumer-buying security whenever a purchase is made.

With all the data breaches over the past couple of years, it’s no wonder that Apple Pay is being well-received by consumers, retailers, and financial institutions. The service has the potential to exponentially improve consumer-buying security whenever a purchase is made.

Traditional point-of-sale payment processing relies on the exchange of your credit or debit card number along with other sensitive information. As we’ve seen in far too many cases, all a hacker has to do is crack the firewall once to monitor a company’s transactions. For as long as the breach goes undetected, the hacker collects the purchaser’s information for every single transaction.

Apple Pay operates by creating a single-use token for every transaction. This eliminates the need to pass card and other sensitive information for the transaction. The network of merchants who accept Apple Pay is growing. Someday, the service may become as commonplace as point-of-sale terminals are today. Unfortunately, with new ideas come new opportunities for scammers.

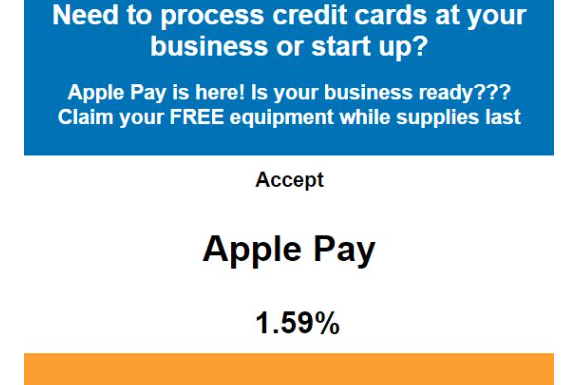

The email I received is, I believe, the tip of the iceberg. It’s targeted at small business owners who likely have heard about Apple Pay and might be interested in taking payments via this method. The links in the email I received led to a website located in Gujarat, India that has been blacklisted for phishing and/or malware distribution.

This week’s Sunday Scam Tip is to play it safe when it comes to paying or collecting money. If you’re a consumer and want to learn more about Apple Pay, visit the information page at Apple.com. If you’re a merchant, check with your current payment processing service. In both cases, you’ll learn a whole lot more about Apple Pay from a legitimate source than you will from a scammer out of India.