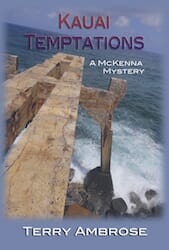

“This book is dedicated to the victims of identity theft. I am one of you. I never expected to have someone steal my identity. I wondered why more couldn’t be done to find the perpetrators. And I wanted justice.” That quote is the dedication of my new McKenna Mystery, “Kauai Temptations.” The book uses identity theft as the launching pad to put McKenna into his next adventure, but it also brings up a point everyone needs to be aware of: identity theft is a $50 billion per year business.

“This book is dedicated to the victims of identity theft. I am one of you. I never expected to have someone steal my identity. I wondered why more couldn’t be done to find the perpetrators. And I wanted justice.” That quote is the dedication of my new McKenna Mystery, “Kauai Temptations.” The book uses identity theft as the launching pad to put McKenna into his next adventure, but it also brings up a point everyone needs to be aware of: identity theft is a $50 billion per year business.

One way identity thieves work is through the use of “phishing” websites, those designed to steal personal or financial information. A recent development is the fake state medical insurance marketplace. For instance, in California the legitimate site is at coveredca.com. In each state, there may also be other private organizations attempting to provide information to consumers. This situation has created a ripe environment for scammers to lure unsuspecting victims to phishing sites.

How do you get to one of these fake websites? One of the easiest things for scammers to do is to create a site with a domain that is similar to a legitimate domain, but that might be a common misspelling or word reversal. For instance, in California, a site was created for “California Covered” rather than the official “Covered California.” Another group of scammers have benefited greatly over the years through the many misspellings of “Swarovski.”

How would you know if you’re on a phishing site? Unless it’s done poorly, you probably wouldn’t. Fake “brand” websites, whether they’re for the medical insurance exchange or Swarovski crystal, can look legitimate. That’s why it’s critical to check the domain name in your browser’s address bar while typing it in, rather than after clicking a link on a phisher’s website.